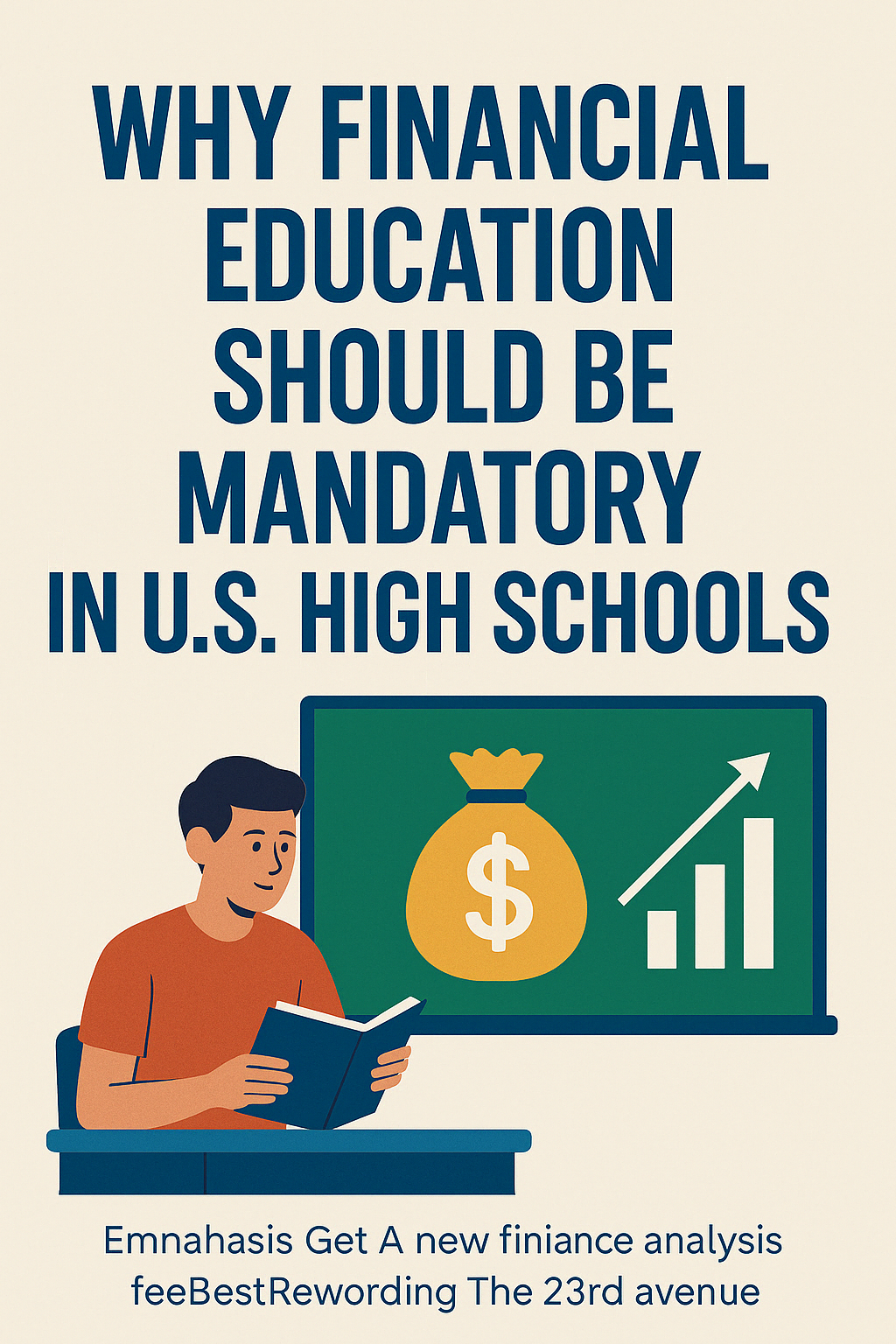

Introduction

In a world where financial decisions impact every aspect of our lives—from paying rent to saving for retirement—it’s surprising that many students graduate from high school without even basic money management skills. Credit scores, interest rates, budgeting, and taxes are essential parts of adult life, yet these topics are often left out of standard high school curricula. As a result, millions of young Americans enter adulthood financially unprepared, making costly mistakes that could have been avoided with just a little guidance.

This is why there is growing momentum across the United States to make financial education a mandatory part of the high school experience. It’s not just a good idea—it’s a national necessity.

The Current State of Financial Literacy in the U.S.

Financial illiteracy is a widespread issue in America. According to the National Financial Educators Council, in 2023 alone, the average American lost $1,819 due to a lack of personal finance knowledge. Young adults are among the most affected. A recent study by TIAA found that only 16% of Gen Z felt “very confident” in their personal finance knowledge.

Only a handful of states currently require personal finance courses to graduate from high school. Many students are left to figure it out on their own—or worse, never figure it out at all. This lack of education leads to poor decisions around credit cards, loans, and savings, often resulting in long-term financial struggles.

Why Financial Education Matters

- Promotes Responsible Spending and Budgeting

Teenagers who learn to budget are more likely to develop responsible spending habits. They learn to live within their means, prioritize needs over wants, and avoid unnecessary debt. - Reduces Student Loan Mismanagement

Many students take out massive loans without understanding interest rates or repayment terms. With financial education, they can make informed decisions about borrowing for college, potentially avoiding future financial hardship. - Encourages Saving Early

One of the most powerful financial tools is compound interest. Teaching high school students about saving early can lead to a lifetime of better wealth-building habits. - Prepares for Real-World Challenges

Whether it’s renting an apartment, buying a car, or filing taxes, financial knowledge gives young adults the tools they need to succeed in the real world.

The Social Impact: Bridging the Wealth Gap

Mandatory financial education isn’t just about individual success—it’s about economic justice. Lower-income students are often disproportionately affected by a lack of financial literacy. They may not have family members to guide them through budgeting, banking, or investing.

By equipping all students—regardless of background—with essential financial skills, schools can help level the playing field. It empowers students to make smarter decisions, avoid debt traps, and ultimately build a more secure future for themselves and their families.

Real-World Examples of Success

States like Missouri, Virginia, and Utah have already implemented personal finance requirements at the high school level. Results are promising:

- Students in these states report higher confidence in managing money.

- There’s a notable increase in savings behavior and decreased reliance on credit cards.

- Some even show lower default rates on student loans.

These examples prove that with the right education, young people are more than capable of managing their finances wisely.

Overcoming the Challenges

Opponents argue that schools are already overloaded with curriculum requirements, and adding another course would be too much. But the truth is, financial literacy doesn’t require a complete overhaul. It can be integrated into existing subjects like math, economics, or even as a stand-alone elective.

Additionally, there’s a growing number of free resources, online tools, and teacher training programs that can make implementation easier for schools. Organizations like Next Gen Personal Finance (NGPF) provide free, ready-to-use curriculum materials that meet national standards.

Support from Parents, Educators, and Employers

Interestingly, there is widespread support for financial education in schools. Surveys show that:

- Over 85% of parents believe financial literacy should be taught in school.

- Teachers agree that it’s important, especially those in underserved communities.

- Employers see financially literate employees as more reliable and responsible, which can lead to better job opportunities for young people.

What Should Be Taught?

A strong high school financial education program should include:

- Budgeting and expense tracking

- Understanding credit and debt

- Savings and interest

- Banking basics (checking, savings, mobile banking)

- Taxes and paychecks

- Loans and borrowing

- Investing and retirement basics

These aren’t complex finance theories—they’re real-world skills that everyone needs.

The Future of Financial Education

With the rise of digital banking, student loans, crypto, and economic uncertainty, financial knowledge has never been more critical. Gen Z is growing up in a unique time where financial literacy could make or break their future.

Making financial education mandatory is a step toward building a more informed, resilient generation. One that isn’t easily swayed by get-rich-quick schemes, predatory lending, or poor money habits.

Conclusion

In today’s fast-paced financial landscape, students can’t afford to graduate unprepared. By making financial education mandatory in U.S. high schools, we give every student a fighting chance to succeed—not just academically, but economically. It’s an investment not only in their future but in the future of the country.

Financial literacy is no longer optional. It’s essential. The sooner we treat it that way, the better off we all will be.

SEO expert with a passion for optimizing websites and driving organic traffic through data-driven strategies.